A Tunbridge Wells entrepreneur who survived the Dragons’ Den by walking away with a £100,000 investment in his company has talked to the Times about his experience.

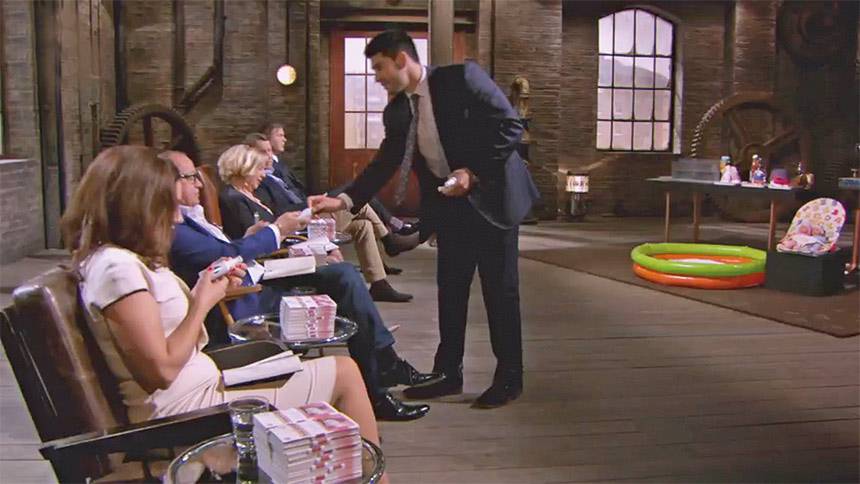

Caner Veli, founder of Liquiproof, a fabric spray which repels liquid spills, was seen giving away 50 per cent of his business to the clothing magnate Touker Suleyman when the BBC2 show aired on January 3.

But it was not all plain sailing for the 28-year-old entrepreneur, who described the experience as ‘one of the most stressful’ days of his life.

After impressing the Dragons with his presentation, in which he highlighted the effectiveness of Liquiproof by pouring a bottle of red wine down his suit, leaving no stains, the tycoons began their ferocious scrutiny.

“It was scary as hell and probably one of the most stressful days of my life,” said Mr Veli, adding: “It is exactly like it looks on TV.

Sceptical

“But what the audience do not realise is there are 25 people off screen watching as well.”

An avid viewer of the show, Mr Veli was none the less sceptical when he was first approached by the BBC to appear on the programme.

He said: “The development team from Dragons’ Den called me up saying they had seen my product and thought it was amazing, so they asked me if I wanted to go in front of the Dragons.

“At first I was not really sure if it was actually a real offer, but of course it turned out to be genuine.”

The main criticisms levelled at Mr Veli’s pitch for investment came from two of the most long-standing Dragons on the panel, Peter Jones and Deborah Meaden.

Mr Jones slammed the valuation of Liquiproof, which Mr Veli claimed was worth £2 million – partially based on forward estimates of growth – but which Mr Jones said would be lucky to be worth ‘tens of thousands.’

“Peter was very grumpy for the whole thing. What the programme did not show was the back and forth which went on,” said Mr Veli, “you don’t know what they are going to ask but you prepare for the worst.

“I was there for about an hour, the bits on screen were probably not even the harshest moments.”

Next up came Mrs Meaden, who took Mr Veli to task for the quality of the contract he had secured with the R&D lab which manufactures the product.

She highlighted the fact the contract had not been drawn up by a solicitor, methodically pointing out various flaws including, most serious of all, the fact the formula itself was not owned by Mr Veli.

Despite this flaw, Mr Veli argued he had secured almost sole global distribution rights and had ownership of the branding itself.

But Mrs Meaden was unconvinced, pointing out the quality of the contract meant Mr Veli was relying mainly on a bond of trust rather than having any legal guarantee he could maintain supply.

Although Mr Veli maintains he had no doubt about the validity of the contract, he did admit from an investor’s standpoint it would have been off-putting.

He said: “I like to think I am an honest person and expect the same from others so from a personal point of view the contract was fine.

“But it was a bit of a schoolboy error bringing in a contract I drafted myself and expecting them to accept it. It is something which has since been remedied.”

After Mr Jones and Mrs Meaden stated they would not be making an offer, fellow Dragons Nick Jenkins and Sarah Willingham also withdrew, leaving only Mr Suleyman.

Mr Veli thought his chances had all but vanished. He said: “It was frustrating because I didn’t see a problem with the business.

Risky

“When they all started dropping out I was like, ‘what’s going on here?'”

However, Mr Suleyman, whose businesses have a lot of exposure to the textile industry, saw much promise in the product, but the risky contract meant his investment would only be brought at a high price.

Instead of the five per cent equity Mr Veli was looking to give away in the company, Mr Suleyman wanted ten times as much for his money.

Describing the moment the offer was made, Mr Veli said: “It was absolutely brilliant and Mr Suleyman was the investor I was hoping to get due to his connections, which are as important as the money.

“Obviously he wanted far more than I said I wanted to give away, but while I was debating with myself about the offer I came to the conclusion that him having a large stake will mean he is more likely to focus on the business.”