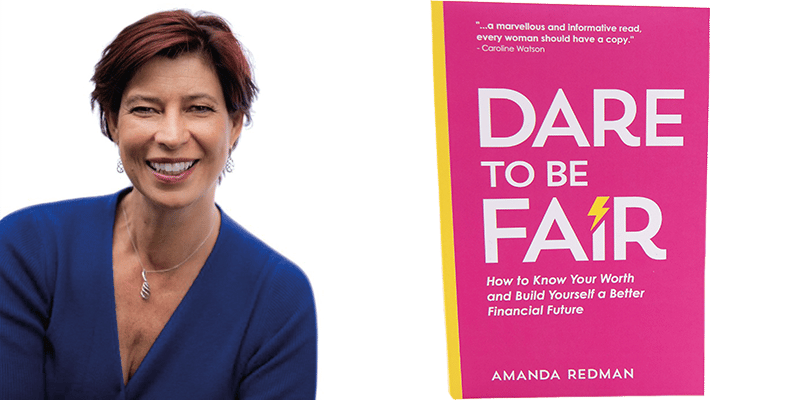

Taking the ‘gender pay gap’ between men and women as a starting point, which is generally driven by maternity leave and caring responsibilities, chartered financial planner and business author Amanda Redman says this translates into an even worse pension gap.

The differences she quotes are stark. In her Dare to be Fair book (2021), she refers a 2019 study showing that, on average, women retire with just 20 per cent of the pension wealth of men at age 65.

Most of it comes down to the ‘multiplier’ effect of salaries and pension investments throughout a working life.

Talking to the Times, Amanda referred to scenarios calculated for her book, showing three women aged 30, all earning £30,000 a year before having a child.

‘Emma’, returns to work full-time after maternity leave. ‘Alesha’ takes a two-year break from work before returning. And ‘Louise’ returns to work part-time (three days a week) and continues this for 10 years, before returning to work full-time.

If Louise manages to transition back to full-time work at age 40, with no salary reduction, she can catch up with Emma salary-wise – but will have earned less for those 10 years.

Alesha’s two years out of the workforce reduce her salary by 3 per cent, compared to Emma’s salary, and she never catches up.

However, in terms of pension pots, Amanda sees extreme differences between these realistically modelled lives, due to the ‘multiplier effect’ of investments over a working lifetime.

At 60, Emma’s pension pot would be worth £212,509 thanks to her uninterrupted career and pension contributions, whereas Alesha’s pension pot would be worth £185,483 and Louise’s only £171,826.

Having children and going on maternity leave is the turning point, she told the Times.

“One mechanism is to ensure that when you go on mat leave you claim Child Benefit,” she advised, explaining that even if the partner was a higher-rate taxpayer who had to pay back the money through his tax code, child benefit ‘fills the gap in National Insurance contributions’.

“My fear with no-fault divorce – and I hope I’m wrong – is that it will encourage more people to divorce without working with a solicitor,”

“One other idea is when agreeing that one partner is not going to go back to work, that the other partner pays into a pension on her behalf, even if she is not working.”

She acknowledged that the current cost of living crisis makes this solution difficult, but stressed: “I appreciate that money is very tight, but this [pension contributions] should be considered part of that financial discussion, and it’s important to consider it jointly.”

Ms Redman warned: “In a divorce situation, there is often one party that is financially more literate, and that will typically be the higher earner, typically the man in the scenarios that we’ve been discussing.

“I think that when people divorce using solicitors, normally pensions are part of the conversation. When women are not working with a solicitor, they can be financially vulnerable. And because they don’t always have that the level of understanding about how valuable that pension is, they will shy away from it.

“My fear with no-fault divorce – and I hope I’m wrong – is that it will encourage more people to divorce without working with a solicitor, and that these conversations will happen even less often than now.

“It is the role of good financial advisers to make sure that that conversation does happen and that pensions are an asset that are shared as are all other assets. But at the moment, it’s not a legal requirement, and I do believe that that should be mandated.”

She urged women to remember that even after a divorce, their ex-husband could continue earning and developing his career, and making his pension contributions.

“I went through a divorce in my 30s, so I have experience of it. It is such an emotional time, and not the best time to realise that actually you don’t know what you own jointly, or you don’t know what your husband’s business assets or debts are.

“That’s a very cruel outcome, when occasionally women have responsibility for debt that they had no clue about because they didn’t involve themselves in their financial planning at an early enough stage.”

When Ms Redman takes on a new client, she always asks whether solicitors are involved.

“If the answer is no, because they can’t afford it, it could be a very expensive mistake. It can be a hard, hard circle to square if you don’t have the money available to pay for a solicitor in the short term, but they should end up providing a far better and fairer settlement at the end of the day.”